What are the different RICS survey types?

There are different types of house and types of house survey available in the UK, and the choice of survey depends on factors such as the property’s age, condition, and construction. Home surveys and house surveys come in various formats, with homebuyer surveys being a popular option for many buyers. Home survey reports and survey reports provide detailed information to help buyers make informed decisions about a property. Survey costs, house survey costs, and house survey costs can vary depending on the type of survey chosen and the specific property. Some surveys were previously called by different names, reflecting updates in survey formats over time. You can find out more about the differences between the various RICS Surveys here.

Survey costs

The cost of a house survey can vary depending on several factors, including the type of survey you choose, the size and location of the property, and the fees charged by the surveyor. A basic survey may cost a few hundred pounds, while a more detailed full structural survey can exceed £1,000. When budgeting for your home purchase, it’s important to factor in the home survey cost, as identifying issues early can save you significant amounts in future repairs.

Survey costs can also vary depending on whether you choose a chartered surveyor registered with the Royal Institution of Chartered Surveyors (RICS) or the Residential Property Surveyors Association (RPSA). Comparing quotes from different qualified surveyors will help you find the right balance between cost and the level of detail you need for your property survey. Investing in a professional survey is a wise decision that can protect your interests and provide peace of mind throughout the buying process.

RICS Valuation

A RICS Valuation, also known as a mortgage valuation or valuation report, is a basic inspection used to indicate the value of a property and is required when applying for a mortgage. Mortgage valuations are required by the mortgage lender to assess the property’s market valuation and determine if it is suitable security for the loan. A mortgage valuation is less detailed than a full survey and is primarily for the lender’s benefit, as it does not provide comprehensive information about the property’s condition or potential repairs. It’s also typically needed if there are changes in shared equity, schemes such as Help to Buy, and for tax reasons.

RICS Home Survey Level 1 Report (Condition Reports)

Level 1 Surveys, also known as a condition report, are suitable for new build and modern properties. This survey is designed for conventional properties built from common building materials and in reasonable condition. It provides a brief overview of the property’s condition and is most appropriate for homes that are standard, well-maintained, and have not undergone extensive alterations. The Level 1 survey is not designed to uncover hidden defects or significant structural problems. If any issues are identified during the inspection, further investigations may be recommended. As these surveys are so limited, they are only suited to properties less than five years old and appear in good condition.

RICS Home Survey Level 2 Report (Home Buyers Report)

A Level 2 Survey, also known as a homebuyer report or home buyers survey, is considered a mid level survey. It is suitable for a conventional house or conventional property built from common building materials and in reasonable condition. The survey involves a physical inspection of the property, including the roof space, to assess its overall state. The report provides a market valuation and can include a valuation report to help buyers understand the property’s market value. It highlights any repair work needed, outlines repair options, and may recommend further investigations if certain issues cannot be fully assessed. The report also includes advice on ongoing maintenance required to keep the property in good condition. A traffic light rating system is used to indicate the severity of any issues found. For buyers, the RPSA Home Condition Survey is an equivalent option, offering a consumer-friendly, mid-level, non-intrusive inspection with quality checks.

RICS Home Survey Level 3 Report (Building Survey)

Usually reserved for higher risk properties, for example, older or non-traditional buildings, those constructed from unusual or non-conventional materials, or buildings that have or will be altered/extended. The Level 3 survey is particularly suitable for a rundown property that may have hidden defects or significant structural problems. This is the most in-depth survey available, providing a detailed assessment of the property’s structure and all the features of the building. The report will outline any repair work needed, provide repair options, and may recommend further investigations if necessary.

Choose the right survey for you

Our team of fully qualified and accredited RICS Surveyors will be able to advise you on the best choice of survey for you, and we fully understand the peace of mind that comes from knowing exactly what you’re buying. When choosing a property surveyor, it is important to select a qualified local surveyor who has in-depth knowledge of the area.

Seeking professional advice from a surveyor can help buyers make informed decisions about repairs and next steps before purchasing. The Homeowners Alliance offers valuable guidance on choosing surveyors and understanding the process. While an estate agent or estate agents may recommend certain surveyors, buyers should always conduct their own research to ensure impartiality. It is also advisable to communicate any particular concerns to your surveyor before the inspection to ensure a thorough and tailored survey.

At Robinson Elliott Surveyors, we go above and beyond when carrying out our RICS surveys, providing comprehensive information on the condition of your property. All observations and assessments are thoroughly explained, our colour-coded system makes your report easy to read at a glance, and we’’ll never use complicated jargon.

How to read our RICS Surveys

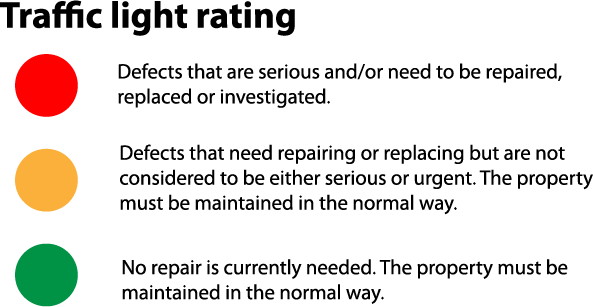

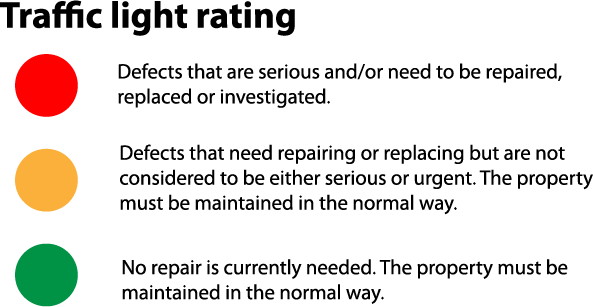

To ensure clarity and to make our reports easy to read at a glance, we utilise a colour-coded system:

Red (3) Refers to severe defects that need to be repaired, replaced, or investigated urgently.

Amber (2) Refers to defects that need repairing or replacing but are not considered serious or urgent. The property must be maintained in the usual way.

Green (1) No repair is currently needed, and the property must be maintained as usual.

NI Not inspected.

The RICS Guarantee

Robinson Elliott is regulated by the Royal Institution of Chartered Surveyors, which requires us to adhere to professional guidelines, offering our clients a highly professional service they can rely on.

A RICS survey provides both the prospective buyer and the serious buyer with confidence in the condition of the property and reassurance that they are paying the right price. With extensive experience in all types of property across the South East of England, Robinson Elliott Chartered Surveyors can help to ensure your property will be safe, in a good state of repair, and that you are paying the right price for your new home, whichever RICS Survey you choose.

Contact our team of Chartered Surveyors at Robinson Elliott Surveyors today to discuss the right survey for your new property.